Rare Earth Minerals are flying too low under the radar?

It seems there has been a fog of war surrounding rare earth minerals for the average investor in recent years. Everyone is so caught up with buzzwords like artificial intelligence, chips, LLMs, and other adjacent terms that they’ve turned a blind eye to any opportunity not branded as “tech.” I myself have largely fallen victim to this trend. Yet, there needs to be a serious conversation about the importance and growth potential of rare earth minerals.

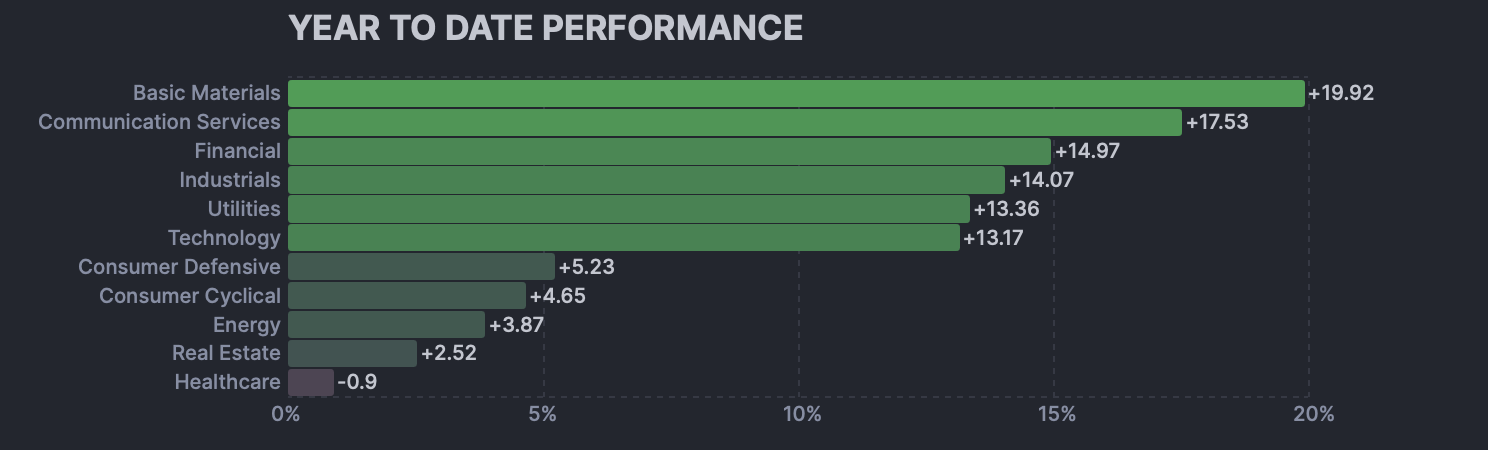

Finvz Sector Map

Basic Materials incompasses the subset of Rare Earth Minerals and is the largest growing sector YTD.

At present, the United States lacks any competitive advantage in the mining and refining of rare earth minerals (mining is the physical removal of ore from the ground, while refining is the complex process of turning that ore into usable metals for industrial applications). In fact, in 2024, China mined 69% of the world’s rare-earth ores and refined 100% of the heavy rare-earth metals worldwide. The U.S. is lagging at about 11.5% of global rare-earth ore mined in 2024, and it exports more than 95% of it to Asia for processing. Currently, due to “national security threats” from increasing tensions throughout the world, the United States has shifted its focus away from exporting and toward in-house refining, which consumes 22 times more water and energy than mining and has a heavy environmental cost in byproducts. This heavy cost is one of the main reasons the United States has sidelined refining.

With this new shift in focus pushed by the govervent we can expect to see growth in many Rare Earth Mineral companies.

This will be part 1, Part 2 will go over the newset goverment contact for these rare earth minerals and the Ukranian Minerals Deal and its effects for investors.

Here are a few I have been keeping an eye on.