CUT TO THE NEWS

The Weekly Cut | 1/5 - 1/9

In the first-ever edition of The Weekly Cut, I break down what moved last week, what the market is watching next, and where investors may start positioning as key sectors face a real stress test.

How December Ends: What History Says About the Market

December has historically been one of the strongest months for the market, and 2024 is shaping up no differently. With the government reopened, consumer spending hitting records, tech earnings crushing expectations, and the Fed signaling a rate cut, the stage is set for a potential Santa Claus Rally. As investors wrap up the year, expect winners to keep running and laggards to face tax-loss pressure. Here’s how I’m looking at the final stretch of the year.

My 6 Month Outlook

The market feels unpredictable, and sentiment is shifting fast. I’ve spent the last few weeks trying to make sense of the signals, the fear, and the strange calm beneath it all. Here are the thoughts I’ve pieced together.

The Palantir Paradox

Palantir ($PLTR) is rewriting the rules of valuation—soaring on AI dominance while trading at levels that make traditional investors cringe. With relentless growth and sky-high multiples, the question remains: is Palantir a glimpse into the future, or the peak of speculation?

The Market Unfazed and the New Investor

Markets once cracked under uncertainty — now they shrug it off. From trade wars to currency shocks, investors remain unfazed as speculation and optimism overshadow fundamentals. The question isn’t what happened to markets, but what happened to investing itself.

Rare Earth Minerals, Where to Look.

Rare earths remain overlooked, but the U.S.–Ukraine minerals deal and domestic subsidies point to future opportunities. MP Materials leads with government backing, Energy Fuels adds rare earth exposure to uranium, and Fluor offers speculative upside in Ukraine’s post-war rebuild.

Rare Earth Minerals are flying too low under the radar?

Rare earth minerals are quietly becoming one of the most critical — and overlooked — investment opportunities of our time. While investors are fixated on buzzwords like AI and chips, the U.S. is struggling to keep pace with China, which dominates both mining and refining. With Washington now pushing for in-house refining despite its heavy costs, rare earth companies may soon see a surge in growth.

New NVIDIA TRUMP Deal

On August 11, 2025, Trump and NVIDIA struck a deal allowing exports of the H20 chip to China, with the US taking 15 percent of sales revenue. This move is expected to boost NVIDIA’s revenue and stock, while raising concerns about national security.

Is Reddit Manipulating the Market?

In a world where Reddit users rally behind tickers like $OPEN and $DNUT for reasons ranging from real analysis to pure chaos, the line between manipulation and momentum gets blurry. Dive into my latest post where I break down how internet-driven investing is reshaping what we think we know about equilibrium, agency, and the market itself.

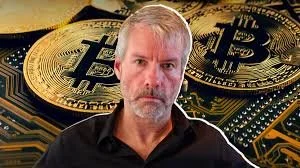

What is MicroStrategy

Why is MicroStrategy ($MSTR) trading at a premium to its Bitcoin holdings? I explain the hype and whether it’s a smart investment or just euphoria.

The Future of Crypto

Ai is here to stay

Is Ai going to be the .com bubble 2.0?

Crypto is Back

is crypto here to stay?

Trump Markets

Understadning the markets under Trump.