The Weekly Cut | 1/5 - 1/9

This is the first edition of The Weekly Cut. This is the first recurring segment you can expect every Monday. The weekly Cut will go over what happened last week, such as shifts in the market and unseen events, and the news for the upcoming week, such as guidance, earnings, and other ideas to pay attention to.

1 Week Sector Heat Map

Market Recap 1/5 - 1/9

S&P 500 (^GSPC) $6,963.74, -$13.53, (-0.19%)

NASDAQ Composite (^IXIC) $23,709.87, -$24.03, (-0.10%)

Dow Jones Industrial Average (^DJI) $49,191.99, $-398.21, (-0.80%)

Unemployment Claims (Prediction 213K -> Actual 208K) The number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions. Lower than the prediction is good for the currency.

This Week

Quick Facts

Monday

Consumer prices rose 2.7% year-over-year in December, according to the Labor Department. (Monday)

Tuesday

Core CPI increased 0.2% month-over-month, coming in below expectations.

Headline CPI rose 0.3% month-over-month, in line with forecasts.

Inflation data broadly matched expectations, reinforcing the current disinflation narrative without a major surprise.

Wednesday

Core PPI (m/m)

PPI (m/m)

Core Retail Sales (m/m)

Retail Sales (m/m)

Earnings-

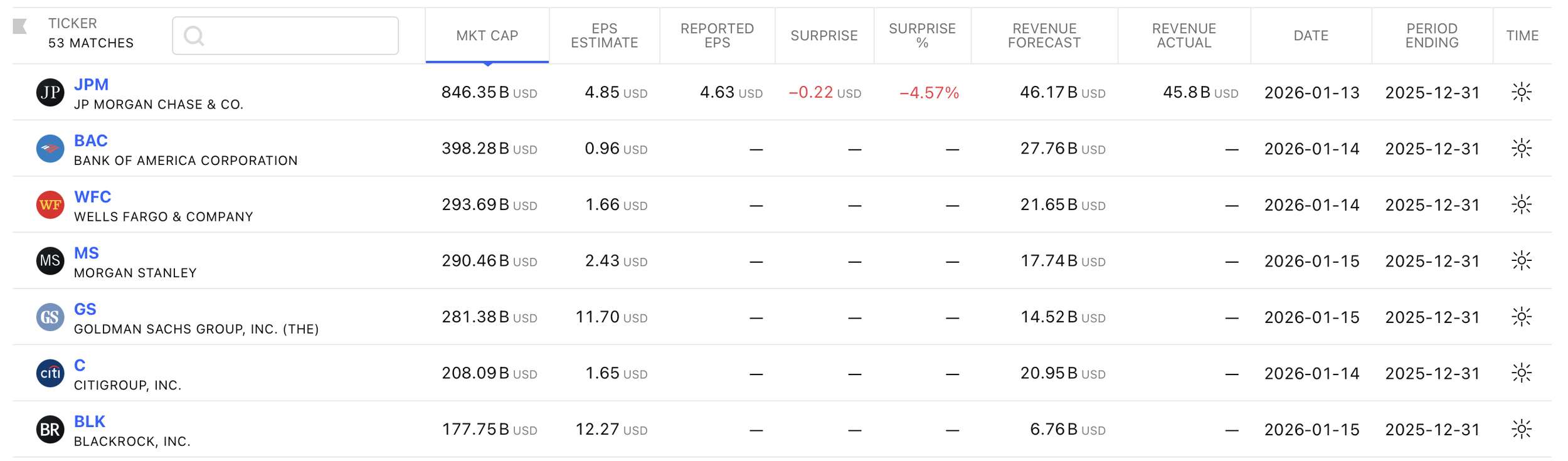

It’s a huge week for financials, with seven major banks reporting earnings.

The Cut

This is where I will break down what to look for through the week and my overall overview of the market. This is an interesting first post because this is going up post-market Tuesday, which gives me the liberty to speak on what has already occurred in the market.

INTC jumped on Tuesday because a KeyBanc analyst upgraded the company to overweight.

A huge spotlight this week will be on financials. The Financial Sector is up 24% over the last year, making it the 4th most earning sector in the market. This week will be a stability check on the sector, with JP Morgan already failing. Is this a sign of things to come or a one-off? Recently, JP Morgan acquired Apple’s credit portfolio for a premium, which could have left a sour taste in investors’ mouths on top of the missed earnings expectations.

Another big focus this week will be on Consumer Defense, Energy, and Basic Materials as tensions across the globe heat up. Investors are seeking to stake a position in a multitude of companies, including Chevron, which stands out above its competitors in the race for Venezuela. On top of that, the United States has made a bid for Greenland, a nation rich in its natural minerals.

It feels as if Pandora's box has been opened, and yet the market continues to grow, which both reassures and perplexes investors.